The $2.6 Trillion Reality Check: Why Canadians Are Switching Mortgages and Racking Up Debt in Q3 2025

- FINANC1FYD

- Nov 27, 2025

- 3 min read

Posted by: The Financ1fyd Team | Date: November 27, 2025

If you’ve felt like everyone you know is either refinancing their house or complaining about their credit card balance lately, you aren't imagining things. The numbers are in.

TransUnion Canada just dropped their Q3 2025 Credit Industry Insights Report, and it paints a fascinating (and slightly worrying) picture of our current financial landscape. We’ve crunched the data to tell you what’s really going on with your money, your neighbors' money, and the Canadian economy at large.

Here is the breakdown of the $2.6 Trillion elephant in the room.

The Big Number: Debt is Up (Again)

Let’s rip the band-aid off first. Total consumer debt in Canada has hit $2.6 trillion.

To put that in perspective, mortgage balances alone rose 4.1% Year-over-Year (YoY) to hit $1.89 trillion. But it’s not just houses. Non-mortgage debt (think credit cards, car loans, and lines of credit) is up 4.3%, totaling $673 billion.

What does this look like for the average person?

If you take away the mortgage, the average Canadian consumer now carries a balance of $27,100. That’s up 2.6% from last year. We are officially seeing borrowing habits shift back to the "moderate growth" pace we saw pre-pandemic.

Here is a quick look at how the numbers have changed over the last year:

Metric | Q3 2025 Value | YoY Change |

Total Consumer Debt | $2.6 Trillion | +4.1% |

Total Mortgage Balances | $1.89 Trillion | +4.1% |

Total Non-Mortgage Debt | $673 Billion | +4.3% |

Avg. Non-Mortgage Balance | $27,100 | +2.6% |

Credit-Active Consumers | - | +2.7% |

The "Mortgage Churn" is Real

Here is the most interesting trend in the Q3 2025 report: Mortgage originations jumped 18%.

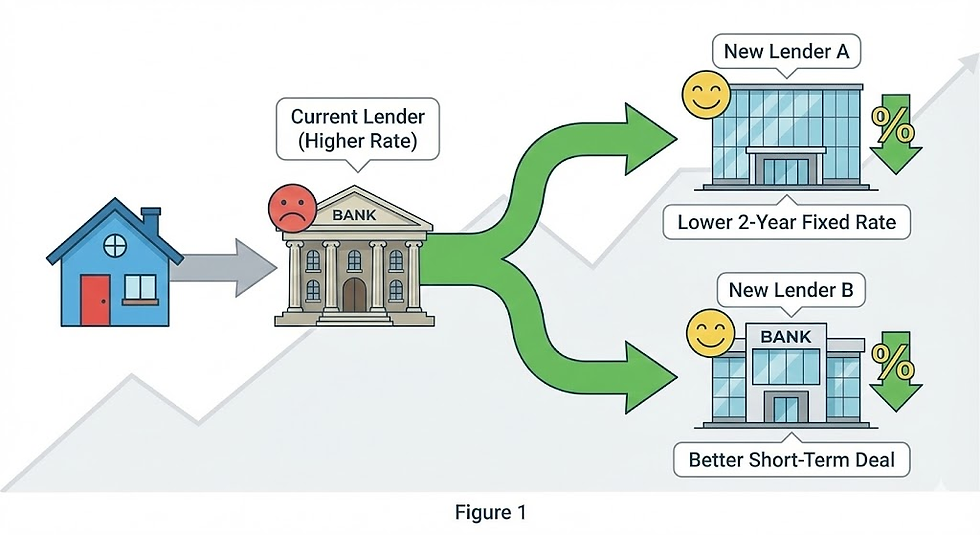

Why the sudden spike? Interest rates. As rates have started to lower, Canadians aren't sitting still. They are shopping around. We are seeing a massive trend of "churning"—where borrowers leave their current lender to find a better deal elsewhere.

Specifically, Canadians are opting for shorter-term fixed mortgages. The strategy is clear: lock in a lower rate now for a short time, and hope that when renewal comes up in 2 or 3 years, rates will have dropped even further.

Figure 1: The "mortgage churn" in action. Canadians are actively switching lenders to take advantage of lower, shorter-term rates.

Expert Take:"In today’s elevated interest rate environment, consumers are potentially tempted to opt for shorter-term mortgages to optimize for renewal at favorably lower rates. Lenders will need to watch out for shifts in market share... as consumers shop around for more affordable rates."— Matthew Fabian, Director of Financial Services Research and Consulting at TransUnion Canada

The "K-Shaped" Struggle: Who is Falling Behind?

While many are capitalizing on new mortgage rates, the report highlights a deepening economic disparity. We are seeing a split in how people are handling their bills.

The Good News: Early-stage delinquencies (missing a payment by a few days) are actually down.

The Bad News: Late-stage delinquencies (90+ days past due) are rising.

This suggests that while most people are managing, those who were already on the edge are falling off the cliff. The financial squeeze isn't affecting everyone equally.

The Hotspots:

The data shows a clear regional divide. If you live in Ontario (+6 bps), Alberta (+10 bps), or Quebec (+5 bps), you are in the zones with the sharpest increases in serious delinquency, while other provinces like Saskatchewan and Manitoba are actually seeing a decrease.

Figure 2: Map of Canada showing the year-over-year change in 90+ day delinquency rates (in basis points) by province for all credit products. Darker blue indicates a higher increase in delinquencies.

Credit Cards are Cooling Down

In a surprising twist, the credit card market is showing signs of slowing down. Originations (new cards being opened) have declined.

This could mean two things:

Consumer Caution: We are getting smarter and realizing we don't need another piece of plastic in our wallets.

Lender Tightening: Banks might be getting stricter about who they lend to as those delinquency numbers creep up.

The Financ1fyd Bottom Line

The Q3 2025 report tells us that Canadians are active right now. We are moving our mortgages to save money, but we are also carrying heavier balances on our other debts.

Our advice?

If you are part of the $27,100 average non-mortgage debt club, keep an eye on those interest rates. If you are a homeowner, don't be loyal to your bank if they won't give you a break—clearly, 18% of your fellow Canadians are already voting with their feet.

Stay Financ1fyd.

Comments